Did you know that India is the largest milk producer in the world, accounting for nearly 24% of global milk production? In March 2025, the Union Minister of Animal Husbandry and Dairying, Rajiv Ranjan Singh, revealed that around 10 crore people in the country are engaged in milk production. He also announced India’s target of producing 300 million metric tons (MMT) of milk in the forthcoming five years.

With the Indian dairy industry in full swing, it is excellent news for individuals interested in setting up a dairy farm and earning substantial profit. Starting and sustaining a business comes with challenges, with the lack of funds topping the list. Luckily, today, you can secure a dairy farm loan to grow your business steadily. Keep reading to learn more.

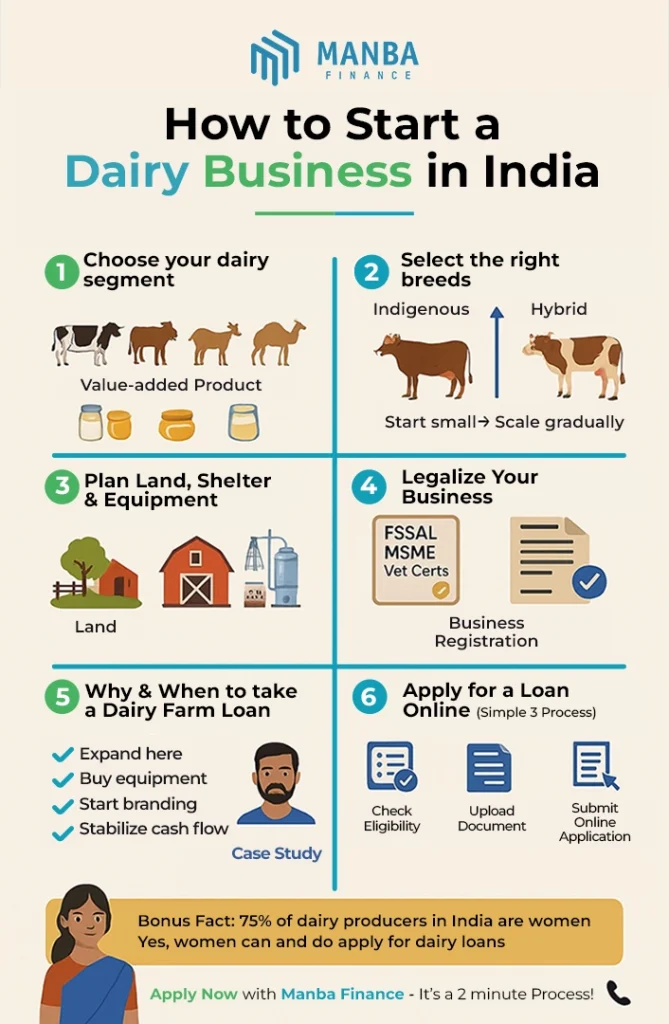

A step-by-step guide to starting a dairy business in India

Starting a dairy business requires careful planning and execution. A detailed dairy farm business plan will significantly contribute to your long-term success. Here are four crucial steps to help you get started:

Step 1: Choose your dairy segment

Firstly, decide the type of dairy farming you want to do. The common types include cow, buffalo, goat, sheep, and camel dairy farming. You can also decide what value-added products you aim to produce and sell apart from milk, such as curd, ghee, and paneer.

Step 2: Select suitable animal breeds

Next, conduct online research and talk to industry experts to choose the animal breeds for your dairy farm. At this point, you must also determine the number of cattle or other animals for your farm. It is best to start with a small, manageable herd and scale up gradually with a dairy business farm loan.

Step 3: Plan land, shelter, and equipment

Think about the location of your dairy farm business. Additionally, figure out the necessary equipment and infrastructure, like animal shelters, milking parlours, storage facilities, and more. You must also consider animal care expenses such as food and veterinary services.

Step 4: Formalize your business

Register your business and obtain the FSSAI license, local municipal license, veterinary registration, MSME registration, and other applicable permissions.

When should you consider a dairy farm loan?

Let’s take a scenario to understand this in depth. Ankit started a dairy farm with his savings in Vasai. After four successful years in the business, he decided to increase the number of cattle, upgrade the infrastructure, and invest in branding and marketing. While he had some funds, they were not enough to implement all the new growth strategies. Ankit had two options: Government subsidy schemes and NBFC cow dairy farm loans.

While the government schemes were promising, they required multiple documents and were a relatively slower process. When Ankit searched for a collateral-free business loan, he discovered Manba Finance. The benefits were attractive—easy eligibility, online application, minimal documentation, quick approval, flexible tenure, and affordable dairy farm loan interest rates. He applied and successfully secured the loan required for his dairy farm business.

The takeaway for you? A dairy farm loan is beneficial if you want to:

- Expand your herd size

- Invest in infrastructure such as automated milking machines, milk coolers, and more

- Produce a range of milk products such as ghee or paneer

- Launch a brand and market your products locally or online

- Stabilize your cash flow during seasonal variations in milk production.

Dairy farm loans online apply—the easy and quick method!

Applying for a loan online involves three parts, namely your eligibility, documents, and application form. Let’s break it down further:

- Check your eligibility: The eligibility criteria usually consider the type of business, cash flow, age requirements, and credit scores.

- Gather the documents: This includes proof of identity, address, business existence, property ownership, and the last six months’ bank statements.

- Fill out the online application form: Check the dairy farm loan interest rates and use the Vyapar Loan EMI Calculator to decide on a suitable loan amount and repayment tenure. After that, complete the form and click the submit button!

Get a dairy farm business loan with Manba Finance!

Manba Finance can be your reliable financing partner if you decide to get a cow dairy farm loan. We offer loans between ₹75,000 to ₹10 Lakhs, with flexible loan terms. Each application is evaluated on a case-by-case basis, ensuring you get a tailored solution that suits your business needs.

Read more about the Manba Business Loan on our website or give us a direct call! Ready to apply straightaway? Fill out the 2-minute application form today!

Dairy farm loan FAQs

1. What are the basic requirements for starting a dairy business in India?

Remember the following aspects involved in launching a dairy business: Animals, fodder, and veterinary care > Location > Infrastructure and technology > Registration and licences > Funding (initial capital + dairy farm business loan + government subsidies) > Suppliers and distributors > Branding and marketing > Manpower.

2. Can I get a business loan to start a dairy farm in India?

Yes, you can easily secure a loan for your dairy farm through NBFCs, such as Manba Finance. Be sure to check your business loan eligibility, gather the necessary documents, and compare dairy farm loan interest rates from different lenders to find the best deal.

3. Can women apply for dairy business loans in India?

Absolutely! 75% of the people involved in milk production in India are women. Women entrepreneurs are more than qualified to apply for dairy farm loans, with many financial institutions offering specialized loan programs for women in agriculture.